- The Slipstream

- Posts

- #49: Back to the Cryptoverse

#49: Back to the Cryptoverse

And why you should also ride the web3 wave

Welcome explorer

You’re back in the Slipstream. Your portal to financial freedom.

You’re here because you know one thing:

The better your thinking, the better your life

This week’s Slipstream is here to help:

🏄🏻♂️ The Journey: Back to the Cryptoverse

💡 The Idea: Why Bitcoin and crypto are leading the next evolution of the web (aka web3)

📚 The Level-up Library: The logical fallacies of veganism, and levels of thinking

WEALTH

Back to the Cryptoverse

The largest ETF in financial history was launched a few days ago, and it was for Bitcoin!

While the price has yet to see significant appreciation yet, this news marks the decision and ability for large institutions to direct capital under management into Bitcoin as part of their strategy.

This is huge. And it’s one of the reasons I’ve gotten back into crypto since the year kicked off. The other being the halving is less than 100 days away and the bull market is about to kick in full gear.

This is the time to prepare, to read up, to build systems and to accumulate capital.

For anyone looking to make extra money on the side, I can’t think of a better way than doing some airdrop hunting while getting exposed to web3.

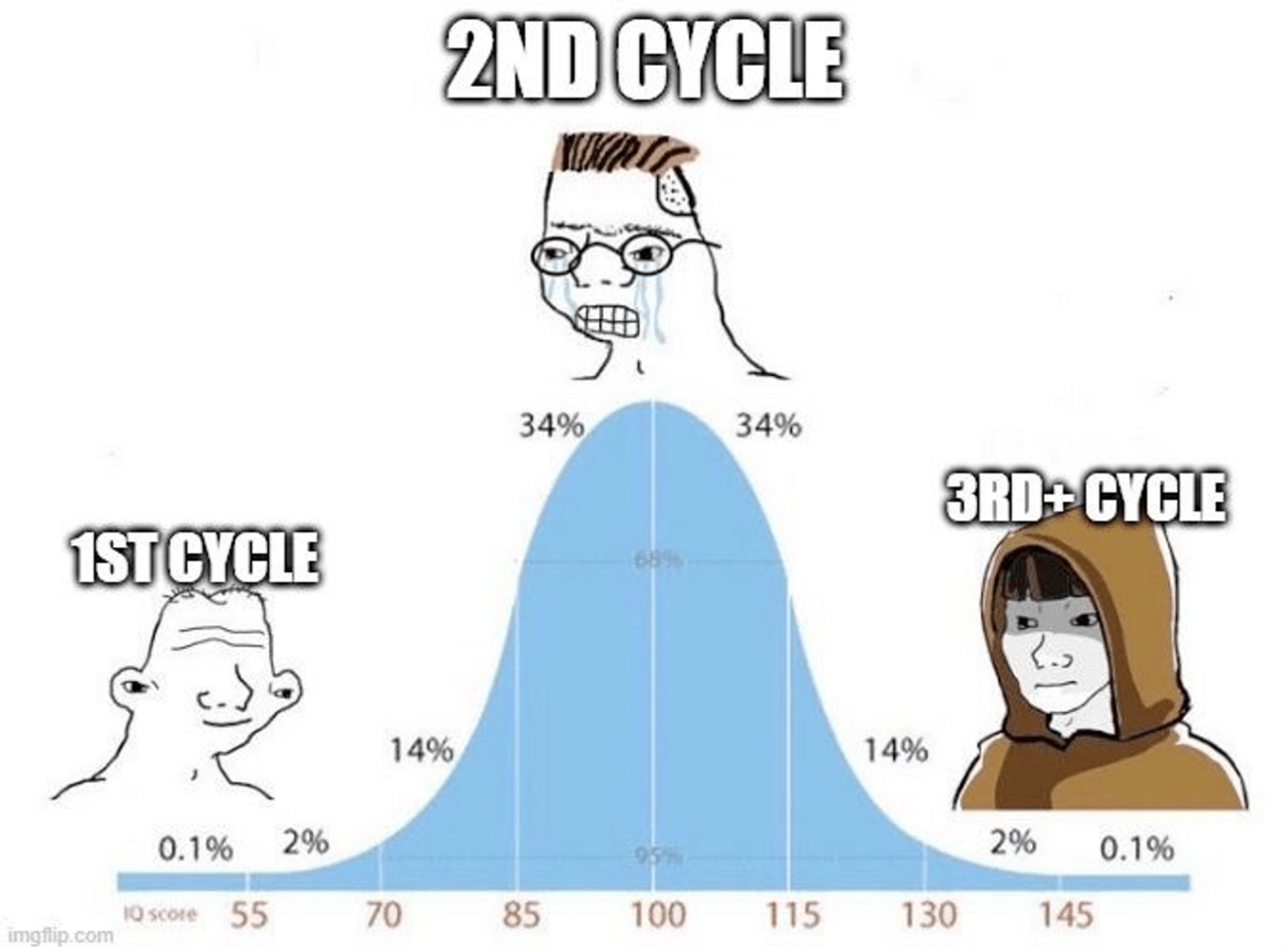

This is my third cycle, and while I rode the other two, I always joined late and was distracted and less knowledegeable

While I do feel like I’ve got some wisdom, I’m not sure it’s at the Jedi level just yet. Well, the only way to get better is to be in the market.

With some effort and being close to the market, anyone can turn a few thousand dollars into over $100,000 this bull run.

This year, I’ll be sharing more of my knowledge and techniques through this newsletter. But for those that really want to maximize their earning potential, be sure to join the community where there’s action happening everyday.

Crypto moves at a 5-10x faster speed that the normal world. And the field is so advanced that one person cannot be on top of everything. One needs a community around them to help surface the best opportunities across the cryptoverse.

That being said, the best place too start for newbies is in airdrops, which I wrote about in Slipstream#47 here

Airdrops are the best way to go from $0-200 to $10,000-$20,000. It takes some time and effort, but its the lowest risk way of earning money while learning about crypto and best practices to keeping safe and protecting your money.

I’ll be opening up the community to the public soon. If you want to be an early alpha tester (for free) reply to this email that you you want to be included.

Airdrops are an ever-changing opportunity. They involve looking to the future anywhere from days to a year or two ahead and having an element of luck. The way to succeed is to spread your bets across a few projects.

However, because there is so many you most likely will miss more airdrops than you qualify for.

After all, right now I’ve got a list of over 140 projects that have a potential airdrop. Even working full-time at this, I wont be able to try my hand at them all.

This is why its important to be strategic with your time, effort and energy. Some airdrops are worth more than others, some ask for much more effort and reward little.

This is where its helpful to have a community around you also working in this space and hunting and testing out opportunities. It’s the best way to stay current and thus capture the best opportunities in the market.

This week, I’m sharing a basic guide to hunting the best airdrop on the market. It probably only has a week or two left. Join The Crew if you want to be in on it.

But first, learn more why I’m so bullish on Bitcoin and crypto now more than ever.

LIFE/ WEALTH

Why Bitcoin and crypto are leading the next evolution of the web (aka web3)

One of the main reasons I cannot leave the crypto space is because of the immense world-changing potential I see there.

It truly is the next version of the internet.

Let me explain.

The first internet that launched, now called web1, refers to an internet of static webpages called up through simple directories. It was basically a read-only version of the internet, for most users.

The second internet, called web2, refers to the era of blogging, Facebook and social media in general. You can not only read, but write. Not just consume, but create. Web2 has been quite exciting and gave rise to technological behemoths such as Google, Facebook and Amazon. These companies benefited from their users activity and creativity.

Web3 is about democratization. It offers ownership of the companies of the internet and of the content you produce. Web3 is about decentralization, putting the power back into the hands of the people.

This is why this is one of the greatest wealth generation events in our lifetimes and that of our ancestors. With the speed of the internet, the virality of social media, we now have innovations that move at a breathtaking pace.

The first innovation of web3

The first innovation of web3 is what we’ve been hearing most about - Bitcoin. But beneath the product/ application that is bitcoin, is the innovation of blockchain technology.

Bitcoin is an innovation in money. It replaces the Federal Reserve and the US Dollar. This is why the US government and other governments are fighting it. The innovation is that we can have a store of value which of which supply is controlled mathematically and not dictated by any third party. It puts money back into the hands of the people, as it should be.

Bitcoin achieves through a technological innovation, called blockchain technology. This a new way of constructing databases and connecting computers to create a “super-database” or even “super-computer”. Blockchain technology gives certain properties to these super-computers. Properties such as immutability, ownership, pseudonymity, public access, etc. Designing different blockchains for different purposes and with different properties is how we got over 2,000 cryptocurrencies today, and continue getting more.

I’m definitely oversimplifying the genius that is bitcoin.

Seriously, it is a world-changing invention that truly puts power back into the hands of the people and away from government.

Blockchains are individual (digital) economies

Because blockchains allow us to transact directly with each other, we can have an economy without the dabbling of third parties who have used the tool of money in the past to suppress human livelihood and progress. In fact, the blockchain is the third party. And you pay a fee for the settlement of the transaction, called the gas fee or transaction fee.

Now that we have the basic layer on which we can transact with each other, and a place to store the fruits of our labors, i.e. money, there has begun a proliferation of other applications that can run on this network, alongside it or independently of it.

Each network, or blockchain, can be thought of as its own economy. Just like how Bitcoin works, these different blockchains work on the same basic underlying principle, but have innovated in various ways. This gives them different functionality and thus suit different purposes well.

For example, we have Ethereum which is more of a general all-purpose internet “super-computer”. You can ask it to do certain calculations (also called transactions), and you pay for usage through Ether tokens (denominated ETH). You can build apps for it (called decentralized Apps or dApps) much like you would build apps for a phone.

We have a blockchain like Filecoin and Arweave which provide storage features - like a harddrive.

We have Solana, which allows for high throughput of fast transactions at really cheap costs - to create the space for high-frequency trading, like a Nasdaq.

Some projects are allowing users to rent out their hard-drive space on their computers for decentrailzed storage, much like you would rent out a spare room for Airbnb.

Basic Financial system

The entire financial system is now being replicated in web3 form.

In the web2 world, sending money across the world involves many third parties and a significant amount of fees. Also you can expect a 3-day wait time, if you’re lucky.

In web3, you can send money across the world, 24/7, with minimal fees and nobody else knowing or questioning you about it.

Bitcoin is the money for web3, it moves in the way we expect things to move online. Though its user experience is still catching up to the ease of web2. It’s only a matter of time, and right now you can send and receive crypto through a chat-app like Telegram which has a built in crypto wallet!

Legitimacy - The institutions are here

After a long battle, the corrupt financial system has yielded to the better technology that is Bitcoin and are forced to create ETFs.

While I am not a fan of ETFs, as they go against the principle of holding your own money, it still is a significant win in that it shows that the institutions recognize the safety of the Bitcoin blockchain, and the soundness of the technology as an investment vehicle for their clients.

This means we have billions of dollars in demand coming into Bitcoin now and on a regular basis going forward.

As everyone has money they put towards retirement and savings, which go off every month, we can expect that a portion of the worlds savings will be diverted to Bitcoin on a monthly basis forever more.

Over time, the portion that people will put toward bitcoin will increase as they see it surviving and growing in price, giving them confidence in its ability to be an inflation-hedge.

Infinity / 21 million

Did you know that there’s only going to be 21 million Bitcoin coins created (mined) ever?

This is part of the ingenious design of the system. A hard, fixed supply of money.

As more dollars get traded for Bitcoin, or in the example above, more dollars flow into the pool of bitcoin, each Bitcoin becomes worth more dollars.

If we think of dollars as water and bitcoin as balloons it might make more sense. We only have 21 million balloons. That’s what the bitcoin network is. But each balloon can hold an infinite amount of water - i..e the price of Bitcoin can always go higher.

For example, the current price of Bitcoin is let say $40,000. The market cap of Bitcoin, is the number of Bitcoin times its price, which is about $800 Billion.

Compare this to gold, who’s market cap is $13.6 Trillion.

The price is set by supply and demand. As more dollars flow into the network, i.e. more people buy gold, the value of the gold (in per oz or per bar) will go up. If you add more gold to the network, the dollar value per gold goes down, since there’s more gold to divide the dollars among.

But, there’s only ever 21 million Bitcoin. So there wont be the possibility of adding more Bitcoin to the network.

However, that wont occur until 2140 or so, when the last ever Bitcoin will be mined.

You see, we only have about 19.6 million bitcoin currently in existence. The network is built in such a way that it rewards the miners - the people who run the computers who run the bitcoin software to keep this system running.

As people use the network for transactions, a transaction fee is sent to the miners as well.

So miners earn in two ways - block rewards (for running the bitcoin software) and transaction fees. Block rewards are the bitcoin that’s rewarded to a miner when they successfully add a block to the bitcoin blockchain.

When the bitcoin network first started, you were rewarded with 50 bitcoin for finding a block, and you could run the software on your laptop. Nowadays, you need specialist equipment that costs thousands of dollars and the block reward is down to 6.25 Bitcoin, but only for a few more months.

The bitcoin reward halves every 4 years, until eventually by 2040 there wont be any bitcoin rewards for blocks and miners earn from transactions fees only. The idea is that by then, more people would be using the network and thus transaction fees would be much higher and be able to compensate for lack of block rewards.

Well, the next halving is about 3 months away. And with it, marks a move upwards as the amount of bitcoin coming into circulation halves.

Lets say a billion dollars comes in every month from the ETF to buy bitcoin. Currently, about 27,000 Bitcoin are mined every month. However, in 3 months thats going to change to 13,500 every month. Yet the amount of dollars coming in for it will probably be even higher than today.

What’s going to happen, you think?

Price. Go. Up.

Get in early

This is why you need to get in early, you need to get in now. This is not a space that’s going away any time soon.

It’s the future.

And while its too late to start a web2 Amazon, since that spot is taken, there is still the Amazon of web3 that is yet to come.

And not just the next Amazon. The next TikTok, Instagram, Shopify, Goldman Sachs, Microsoft, etc. Truly billion dollar companies.

And also new kinds of companies that haven’t existed before since we never had blockchain technology.

Some people will build these companies, and many people will invest in then, and a lot of people will make money from it.

Why not let it be you?

All it takes is some time to get up to speed.

Think of it this way, in a year from now 12 months would have passed whether you learnt about crypto or didn’t.

But if you did learn about crypto, you most likely would be wealthier and most definitely would be more knowledgeable about an important, growing field.

To use a surfing analogy, you either wait for the wave of the future to arrive and overwhelm you, or you jump and paddle into it, catch it early before it breaks and then ride it out past the suckers that weren’t fast enough.

During the last bullmarket, when Bitcoin hit $69,000, people messaged me saying they wish they had bought it when I told them about it. Today, it’s below that price at ~$41,500.

In 5 years from now, you will wish you had bought more.

Crypto is only going to become a bigger part of the world. The question is, will it become a bigger part of yours?

Dr. Paul Mason - 'Logical Fallacies of a Vegan Diet: Why you shouldn't feed your child a vegan diet'

An excellent presentation on human nutrition

LEVELS (Basic Version) - YouTube

An interesting explanation of the different levels of thinking/ consciousness one can have and apply to a situation

"If you don't believe it or don't get it, I don't have the time to try to convince you, sorry."

What’s some of your biggest questions and concerns around crypto?

I really want to know and find good answers for them! So drop me a message if you want to learn more about this space.

I reply to every email I receive!

Till the next time,

“Time to hit the (crypto) mines”

Hey, if you enjoyed this edition, it would really help me if you would forward it to a friend or two. You could also be changing their lives with new ideas.

And if you are this friend, make sure to sign up here so you get life-changing ideas like this every week!

Reply