- The Slipstream

- Posts

- #54: The Bitcoin ETF - big deal or nothingburger?

#54: The Bitcoin ETF - big deal or nothingburger?

Your Brilliant Business Idea Just Got a New Best Friend

Got a business idea? Any idea? We're not picky. Big, small, "I thought of this in the shower" type stuff–we want it all. Whether you're dreaming of building an empire or just figuring out how to stop shuffling spreadsheets, we're here for it.

Our AI Ideas Generator asks you 3 questions and emails you a custom-built report of AI-powered solutions unique to your business.

Imagine having a hyper-intelligent, never-sleeps, doesn't-need-coffee AI solutions machine at your beck and call. That's our AI Ideas Generator. It takes your business conundrum, shakes it up with some LLM magic and–voila!--emails you a bespoke report of AI-powered solutions.

Outsmart, Outpace, Outdo: Whether you're aiming to leapfrog the competition or just be best-in-class in your industry, our custom AI solutions have you covered.

Ready to turn your business into the talk of the town (or at least the water cooler)? Let's get cracking! (And yes, it’s free!)

DEEP DIVE

Why is the Bitcoin ETF a big deal?

In a recent community call I was asked about the significance of the Bitcoin ETF.

Quite simply, it’s the biggest piece of news to impact Bitcoin’s in it’s entire 15 year lifecycle.

This is going to create an unprecedented demand shock to the asset.

My prediction - prices are going to go “bananas”.

What’s the change?

Let me give you a brief history lesson on the crypto industry.

Prior to this, the only participants in the crypto had been ordinary people like you and me. Retail investors. People who invest with their own money and life savings.

These are the tech enthusiasts, crypto advocates, traders and gambling degenerates (degens).

Over time, the industry has become more mature, offering better security and services.

The market started to formalize, and bigger companies formed as the market’s needs demanded them. These native crypto companies were holding BTC and other cryptocurrencies on their balance sheet.

They set the standard for companies to use Bitcoin as a balance sheet asset.

Then Michael Saylor came along and showed people with absolute certainty and unwavering conviction that Bitcoin is the BEST form of money that ever existed.

“What’s the second best? There is no second best!” - Michael Saylor

Watch a masterclass by Saylor on Bitcoin here - Link to Twitter

As founder and CEO of Microstrategy, a $26.3 Billion company, he was leading one of the largest machines in the corporate industry. He bought Bitcoin publicly and so turned to a Bitcoin advocate.

Not long after, Tesla bought Bitcoin as well.

The race for companies to own Bitcoin has begun.

All through this time, institutional funds who are used to investing in the traditional markets and achieving low single digit yields were getting FOMO (Fear Of Missing Out) which is a real phenomenon.

Wealthy boomers were putting pressure on their financial advisors to get them exposure to Bitcoin. Because the technology is relatively new, and functions different from the current system, it took some time for regulation to catch up and new processes to be developed for working with and handling Bitcoin.

Grayscale, a private fund, was created to give people Bitcoin and crypto exposure. They worked around regulations by creating a trust for a specific token e.g. BTC trust, ETH trust, etc. If you wanted exposure, you buy a share of the trust. The trust uses its money to buy the crypto.

Institutions could see it was time to put in larger bets on Bitcoin and crypto. They needed to create ETFs to allow their institutional clients to invest, as well as the less tech-savvy retail market.

They submitted application after application. The SEC denied these and gave a lot of lame excuses. It was clear they were trying to hold this industry back.

Finally, one of the biggest funds in the world Blackrock decided to apply for an ETF. They had a 99% success rate and so the writing was on the wall it was going to happen.

And then, it did! The SEC approved the applications by these institutions to develop and market new ETFs based on Bitcoin.

The institutions are finally here!

And with them comes a massive appetite for Bitcoin. After all, it has been the best performing asset of the last decade.

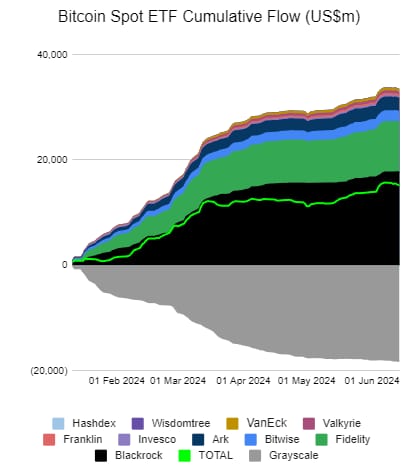

Looking at the numbers, since the Bitcoin ETF launched there has been a net of ~$15 Billion dollars flowing into the asset.

This is only the beginning.

Even more positive, is that these funds will need to custody the Bitcoin - that is they have to buy it off the exchanges and markets. This will have a real impact on prices.

Buy the rumor, sell the news?

The modus operandi when it comes to headline events is the “buy the rumor, sell the news”

That is, buy the asset when there are still rumours of positive events to come. When these positive events occur (as in, the news/team announces them), its time to sell the position.

This may work in most cases, but that’s because most news does not change the fundamentals of the project, and the respective supply and demand.

As you may know, the price of something is the result of a balance of two forces - Supply and Demand

In this case, the news is about a massive change in the fundamentals of the market. An introduction of a new player, and new demand, that has not existed in the Bitcoin ecosystem before.

This increase in demand is expected to cause a a demand shock as an incredibly large amount of new capital is coming to chase the Bitcoin asset.

And as these funds have trillions of dollars under management, they are just testing the waters when they are investing billions. These are single digit % of the wealth they have to play with.

These institutions have realized that Bitcoin is an incredibly valuable asset, store of value and money.

It is true internet money for the internet age.

At 15 years of age, there are young humans who’s entire lives were during Bitcoin’s existence. It’s becoming as normal a thing as the internet.

The future is people will understand and use Bitcoin to the extent people use the internet today, and probably even greater.

The Demand Shock

As we have some big boys entering the crypto space, what can we as ordinary retail investors do?

Well, the ride is going up. So what we can do is best position ourselves in the assets we know are going to be capturing the most of that demand.

That’s Bitcoin and Ethereum.

As we brace for the market price of Bitcoin to adjust upwards based on the new demand, there’s another factor at play that just throws gasoline on the fire - the reduction in supply.

The Supply Shock

Looking back at supply vs demand graph above, you can see that already due to increased demand we can expect prices to go up. What’s even more interesting is that we are also experiencing a supply shock of Bitcoin due to an event that happens every 4 years - the halving (more on that in a future post).

As we now have 50% less Bitcoin’s produced, we can expect the price of the asset to increase if the demand remains the same (and we know it has actually gone up).

That being said, the ETF news is one of the most significant news in Bitcoin’s career. It has given Bitcoin and crypto a stamp of legitimacy, as well as fundamentally increasing the flow of money to this asset class.

The effects of this has not been fully felt, as many other institutions are still doing their research, monitoring the market and dipping their toes slowly.

This is good news for us, as it gives us a little more time to accumulate some digital gold before it hits its parabolic growth curve that’s the signature characteristic of a crypto bull market.

Just remember:

Bitcoin is the future, it’s just unevenly distributed.

Bitcoin is the best money we’ve ever created.

What’s the second best?

“THERE IS NO SECOND BEST!”

WORDS OF WISDOM

If everyone knew everything you know, what good would you be to anyone?

If you want to go deeper, here are 3 ways I can help you:

1. Join The Crew in Discord (free)

2. Join The Crew Pro and be part of the weekly masterminds

3. Download my ebook Ultimate Guide to Airdrops (free) and learn how to make $10,000+ from crypto’s greatest secret

Reply